RBI maintains status quo; keeps key rate static at 4%

Mumbai: The RBI on Friday decided to leave the benchmark interest rate unchanged at 4 per cent but maintained an accommodative stance, implying rate cuts in future if need arises to support the economy hit by the COVID-19 pandemic.

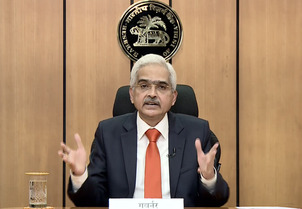

The Reserve Bank’s Monetary Policy Committee (MPC) voted unanimously to leave the repo rate unchanged at 4 per cent, Governor Shaktikanta Das said while announcing the decisions taken by the panel.

“It also unanimously decided to continue with the accommodative stance of monetary policy as long as necessary at least through the current financial year and into the next year to revive growth on a durable basis and mitigate the impact of COVID-19, while ensuring that inflation remains within the target going forward,” he said.

Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks for their deposits kept with the Reserve Bank of India (RBI).

The central bank had slashed the repo rate by 115 basis points (bps) since March last year to support growth.

This is the fourth time in a row that the MPC has decided to keep the policy rate unchanged. The RBI had last revised its policy rate on May 22, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

The 27th meeting of the rate-setting MPC with three external members — Ashima Goyal, Jayanth R Varma and Shashanka Bhide — began on February 3.

This is the first meeting of the panel after the Budget 2021-22 earlier this week projected a nominal GDP growth rate of 14.5 per cent and fiscal deficit of 6.8 per cent for the financial year beginning April 1, 2021.

The government moved the interest rate setting role from RBI Governor to the six-member MPC in 2016. Half of the panel, headed by the governor, is made up of external independent members.

The MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2021, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent.

On inflation, Das said, it has eased below the upper tolerance level of 6 per cent for the first time during the COVID-19 period.

“Going ahead, factors that could shape the food inflation trajectory in coming months, including the likely bumper kharif harvest arrivals in markets, rising prospects of a good rabi crop, larger winter supplies of key vegetables and softer poultry demand on fears of avian flu are all indicative of a stable near-term outlook,” he said.

The projection for CPI inflation has been revised to 5.2 per cent for the fourth quarter of the current fiscal, 5.2 per cent to 5 per cent in the first half of 2021-22 and 4.3 per cent for the third quarter of 2021-22, with risks broadly balanced, he said.

With regard to growth, Das said signs of recovery have strengthened further since the last meeting of the MPC and high frequency coincident and proximate indicators suggest that the list of normalising sectors is expanding.

“Real GDP growth is projected at 10.5 per cent in 2021-22 in the range of 26.2 to 8.3 per cent in H1 and 6.0 per cent in Q3,” he said.

After the Budget 2021-22 announcement on Monday, Economic Affairs Secretary Tarun Bajaj had said that real GDP growth would be 10-10.5 per cent in the next fiscal.

“Our revenue figure is under-stated not overstated. We have taken nominal GDP at 14.4 per cent and revenue growth at 16.7 per cent. So, the buoyancy is only 1.16. We are hopeful we will get more than this. We will definitely be within 6.8 per cent and could be lower also,” Bajaj had said.

The Union Budget 2021-22 has provided a strong impetus for revival of sectors such as health and well-being, infrastructure, innovation and research, among others, he said.

This will have a cascading multiplier effect going forward, particularly in improving the investment climate and reinvigorating domestic demand, income and employment, he added.

As far as gross market borrowing of Rs 12 lakh crore in 2021-22 is concerned, he said the Reserve Bank, as the government’s debt manager and banker, will ensure the orderly completion of the programme in a non-disruptive manner.

“In this context, we look forward to the continuance of the common understanding and cooperative approach between market players and the RBI during 2021-22 also,” he said.

On a review of monetary and liquidity conditions, he said it has been decided to gradually restore the Cash Reserve Ratio (CRR) in two phases in a non-disruptive manner to 3.5 per cent effective from March 27, 2021 and 4.0 per cent effective from May 22, 2021.

The CRR normalisation opens up space for variety of market operations of the RBI to inject additional liquidity.

The RBI has also decided to defer the implementation of last tranche of the Capital Conservation Buffer (CCB) of 0.625 per cent and also defer the implementation of Net Stable Funding Ratio (NSFR) by another six months from April 1 to October 1, 2021.